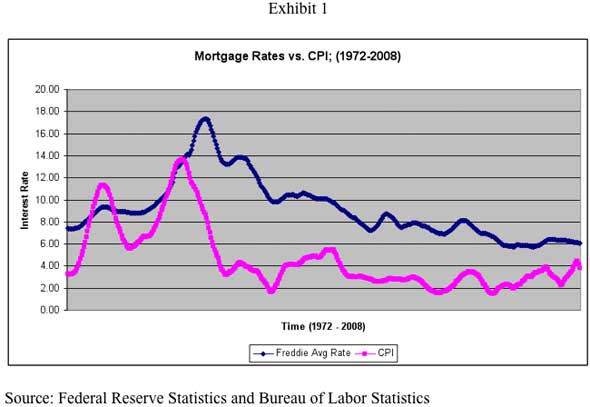

Here are the facts that back up this statement. Exhibit 1 shows a 12-month running average plot of Freddie Mac single family fixed rate mortgages against the 12-month running average of the CPI between 1972 and 2008 (nearly the full period of time mortgage-backed securities had been issued prior to the recent financial crisis).

boswell

Many readers might recall the periods of high inflation that resulted in the 1970s, which are clearly shown in the first quartile of the Exhibit. Many readers might also recall how Paul Volcker in his role of Fed Chairman raised the Federal Funds and Prime Rates significantly in the early 1980s, which curtailed inflationary rates from a 14% annual rate to a 4% annual rate in a short two-year period between the end of 1981 to the end of 1983. That significant drop in inflation can be seen about a third of the way from the y-axis in Exhibit 1.

What most readers (including most economists) do not know, however, is how long-term mortgage rates rose even higher than short-term rates during the early 1980s, and then how subsequently long-term rates have tracked with inflation over time. Both Exhibit 1 and Exhibit 2 can be used to see how they have tracked, and they have not tracked well. And that mistake of allowing mortgages rates to go to 18.0% in 1983, which was either ignored or conceded to by the Federal Reserve, allowed Fannie Mae and Freddie Mac to have unprecedented control of our economy for more than twenty-five years, which significantly led to our current economic crisis.

f there is anything we should learn from the past, it is that long-term rates should not be used to control inflation; unless of course, you believe current inflationary trends are expected to continue for the long-term also. Not only were long-term mortgage rates raised and mishandled in the early 1980s, it is also noteworthy that it took a lot longer than it should have to lower long-term rates. While it took less than two years to go from 14% to 4% inflation, it took more than ten-years to drop mortgages rates a similar ten percentage points from 18% to 8%.

f there is anything we should learn from the past, it is that long-term rates should not be used to control inflation; unless of course, you believe current inflationary trends are expected to continue for the long-term also. Not only were long-term mortgage rates raised and mishandled in the early 1980s, it is also noteworthy that it took a lot longer than it should have to lower long-term rates. While it took less than two years to go from 14% to 4% inflation, it took more than ten-years to drop mortgages rates a similar ten percentage points from 18% to 8%.For the last 27-years (almost the full time for a 30-year loan to mature), inflation as measured by the CPI has averaged 2.99%, yet only very recently have long-term rates begun to come into sync with long-term inflation. With mortgage-rates set so far above what they should have been set in 1983, Fannie Mae and Freddie Mac were allowed to establish a policy that slowly lowered mortgage rates year after year, in effect allowing us to enjoy one refinancing cycle after another so that their mortgage portfolios could grow and grow and grow.

Debt through refinancing meant nothing more than income to these Government Sponsored Enterprises. Not only did the GSEs have free reign on setting mortgage rate policy, they used that power to construct derivative (REMIC-type) products than enabled them to further outwit investors.

Hindsight you say? Considering technological productivity gains, the fall of the Berlin Wall, China-India-Brazil’s development, and globalization in general, how long should it have taken our esteemed economists to understand that inflationary trends could be somewhat tame over the long haul? If you look at Exhibit 1 again, you will see that we have been experiencing the benefits of these factors and low inflation ever since the late 1980s.

How did the GSEs get away with their strategy in light of oversight and investor supply and demand issues? There are two fundamental reasons why:

One, the Federal Reserve was asleep at the wheel. Even though we may revere our esteemed Reserve economists; the Federal Reserve never understood mortgage debt, nor did they ever question mortgage rate policy. Instead, the Fed simply received regular reports from Freddie Mac telling them what the current GSE mortgage rate policy was. The Fed either was ignorant or played ignorant while we added nearly $7.5 Trillion in “new mortgage debt” during the fifteen-year period between 1992 and 2007. Talk about Keynesian economics! Any Reserve Chairman of the Great Depression era would have been envious of what Alan Greenspan was allowed to get away with while collecting accolades—and that does not include the stimulus that was being added during his reign from our Government’s deficit spending and growth in our “national debt”.

Two, demand for Mortgage-Backed Securities, was always there. MBSs have always served as one of the best “risk free” hedges against inflation. An 18% MBS when compared against a 3% long-term inflationary perspective is an extremely attractive product, as is a 14% MBS, as is a 10% MBS. Need I go on? Anyway, what could be safer than investing in American housing? The stock market carries risk, does it not, or have we forgotten what happened in 2000-2001?

So for twenty-five years we Americans took advantage of mortgage rate mistakes made by the GSEs going back as far as the early 1980s to live off our houses and build up our debt to unreasonable levels, while the executives at the GSEs gloated over their growing MBS portfolios and their “well-deserved” bonuses. The money-making machines that the GSEs owned were the envy of Wall Street bankers, so they, too, joined into the game. After all, housing prices would never fall—another gross misconception made by our elite financial leaders.

The good news is this. We will recover from all of our blundering in housing finance, and some day real estate will again offer a means to slowly build equity. The bad news is that housing is not the only major financial problem that needs to be solved in the United States. We still have other big financial issues equally important facing us ahead, including fixing our “health care cost” systems (private, Medicare, Medicaid) and our social security systems. Solutions exist, as long as we understand and face up to our problems head-on. The question remains, however—is that something we are willing to do?

Read more: http://www.businessinsider.com/how-25-years-of-mismanagement-at-fannie-and-freddie-caused-the-financial-crisis-2010-6#ixzz0uT51rfEJ