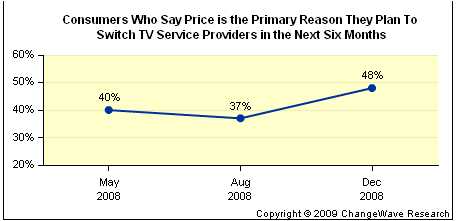

A recent ChangeWave survey of 2,830 respondents finds that price is now the key issue when consumers decide to switch TV service providers.

Nearly one-in-two respondents (48%) who plan to switch their cable, satellite or fiber-optic TV provider in the next six months say price is the number one reason for their planned move.

That’s a big jump from last August, when only 37% of respondents cited price as their chief reason for switching.

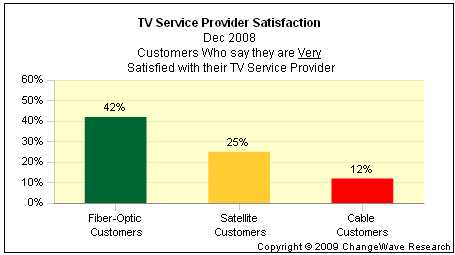

Regardless of price, one segment of the industry continues to lead in terms of customer satisfaction by a country mile.

When respondents were asked how satisfied they are with their current TV service provider, 17% said Very Satisfied while 50% said they were Somewhat Satisfied. But when we broke it down by type of provider, the survey results showed fiber-optic TV services to be in a class by themselves.

Not only did fiber-optic customers give the highest marks to their TV service provider – with an industry leading 42% saying they were Very Satisfied – but that’s up 7-pts since a previous survey in August.

Satellite TV service providers garnered a 25% Very Satisfied rating from their customers, down 5-pts from previously. At the bottom of the spectrum were Cable service providers with a 12% Very Satisfied mark, unchanged from August.

Verizon's (VZ) FiOS service tops the list in terms of having the highest percentage of customers who say they are Very or Somewhat Satisfied with their provider (92%). AT&T's (T) U-Verse service comes in second (87%).

DIRECTV (DTV) (85%) and DISH Network (DISH) (82%) came in third and fourth respectively, followed by the major cable companies.

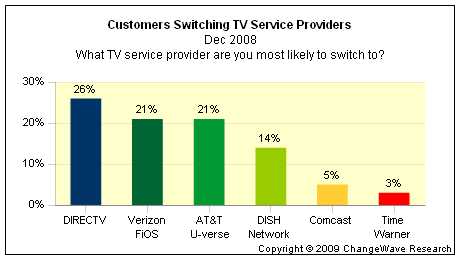

So who are the industry's big winners and losers when it comes to customer switching?

Certainly it's not the cable service providers – only 15% of customers who plan to switch services cited a cable provider as their next choice. The big industry winners, in a split decision, are the Fiber-optic (43%) and Satellite (41%) service providers.

At the company level, DIRECTV (26%) tops the list of providers that switchers plan to move to in the next 6 months.

Just behind, in a dead heat, are Verizon's FiOS (21%) and AT&T's U-Verse (21%) services.